Highlight

Successful together – our valantic Team.

Meet the people who bring passion and accountability to driving success at valantic.

Get to know usMunich, July 1, 2025: Since 2018, the digital solutions, consulting, and software house valantic has been conducting an annual survey among SAP profes-sionals across the DACH region, gathering insights into the current status of S/4HANA migration, investment plans, preferred technologies, emerging business opportunities, and developments in cloud computing and artificial intelligence. Comparing this year’s results with those from previous years makes it possible to identify long-term trends and evaluate ongoing developments. In 2025, a total of 201 SAP experts participated in the survey, which was carried out online during the first quarter of 2025 in collaboration with research house techconsult GmbH.

SAP-based businesses in the DACH region are eager to harness the potential of artificial intelligence (AI)—particularly in conjunction with SAP S/4HANA, the Business Data Cloud (BDC), and the Business Technology Platform (BTP). SAP has already integrated AI extensively into its modules and enterprise workflows. The challenge now lies in leveraging these new technologies to deliver extensive added value and practical benefits in real-world business operations.

But it’s not just artificial intelligence—such as the AI assistant Joule and the SAP AI Foundation—that is sparking discussions in the SAP community. The central themes of the current valantic SAP Study 2025, which are relevant for every company, include migration strategies to S/4HANA, cloud approaches, the SAP BTP integration platform, the still-emerging SAP Business Data Cloud, and digital transformation more broadly.

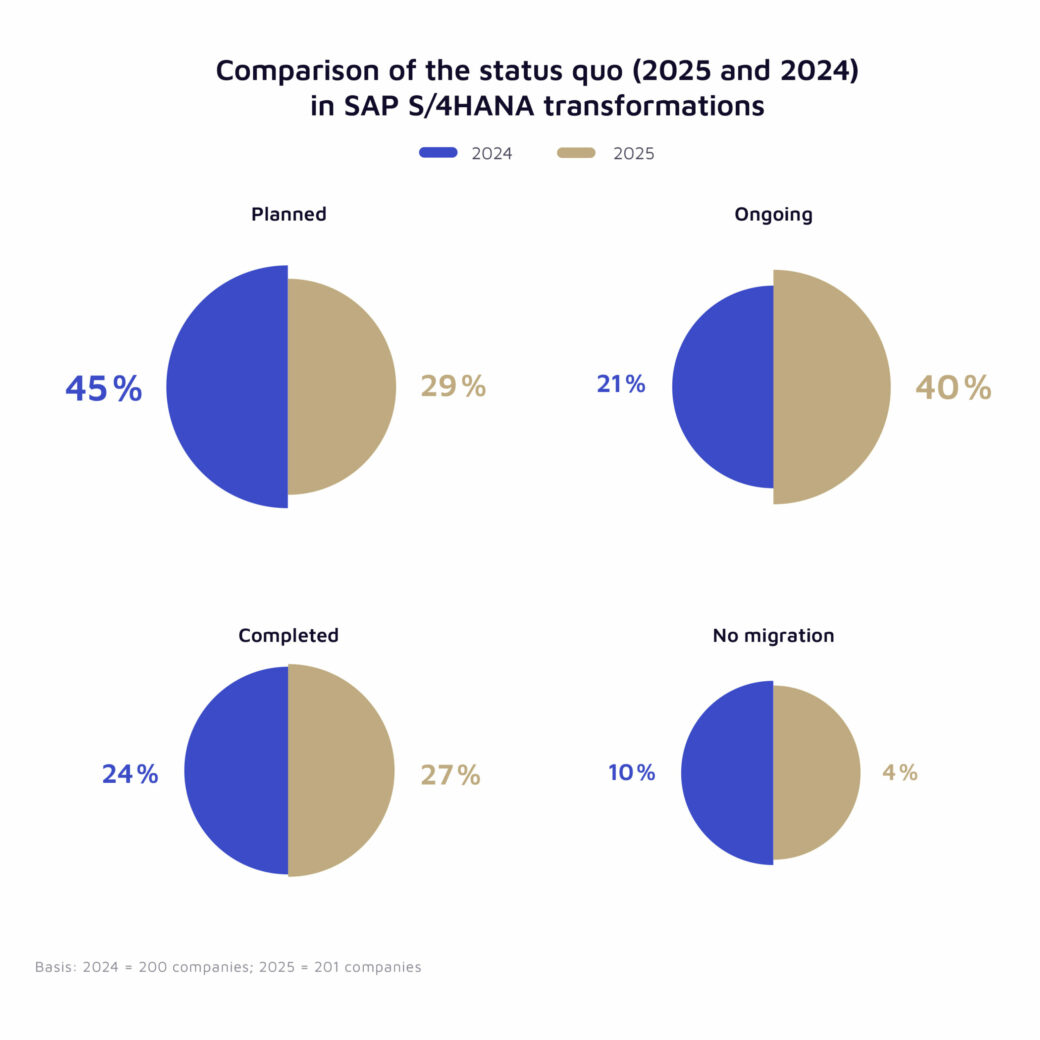

The migration to SAP S/4HANA has seen a huge surge in momentum compared to the previous year, as time pressure continues to mount: the share of companies actively pursuing S/4HANA projects has jumped from 21% in 2024 to 40% in 2025. Meanwhile, 27% have already completed their migration to S/4HANA.

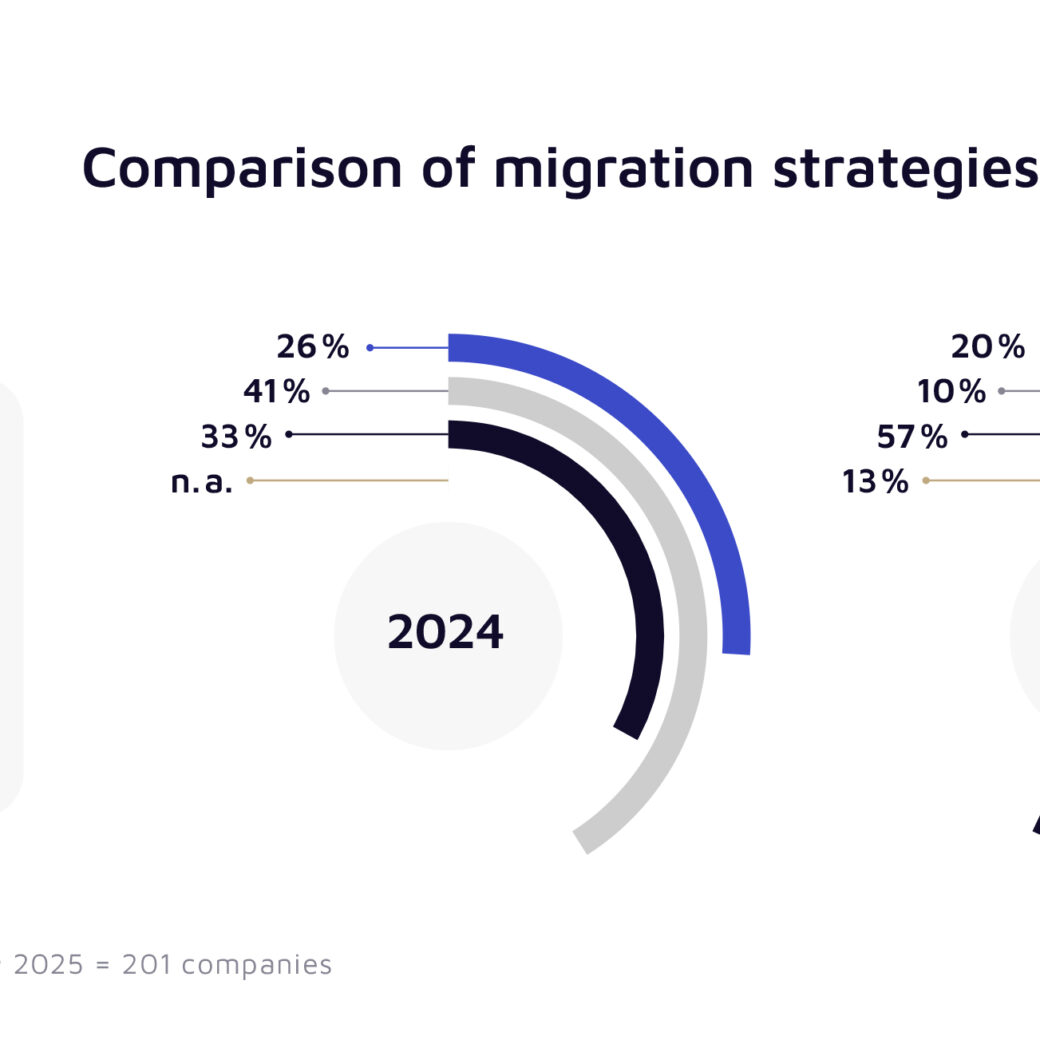

In terms of a migration strategy, 57% of companies are opting for the middle ground: an extended brownfield/bluefield conversion. This approach combines the advantages of setting up entirely new processes from scratch (greenfield implementation) with a purely technical migration (brownfield implementation), which typically involves minimal process optimization.

This hybrid trend reflects a growing recognition that technical migration alone does not equate to modernization. Simply porting existing processes through a 1:1 brownfield conversion no longer suffices. Instead, companies are adopting a structured yet adaptable redesign process that maximizes the potential for boosting efficiency, productivity, and overall competitiveness.

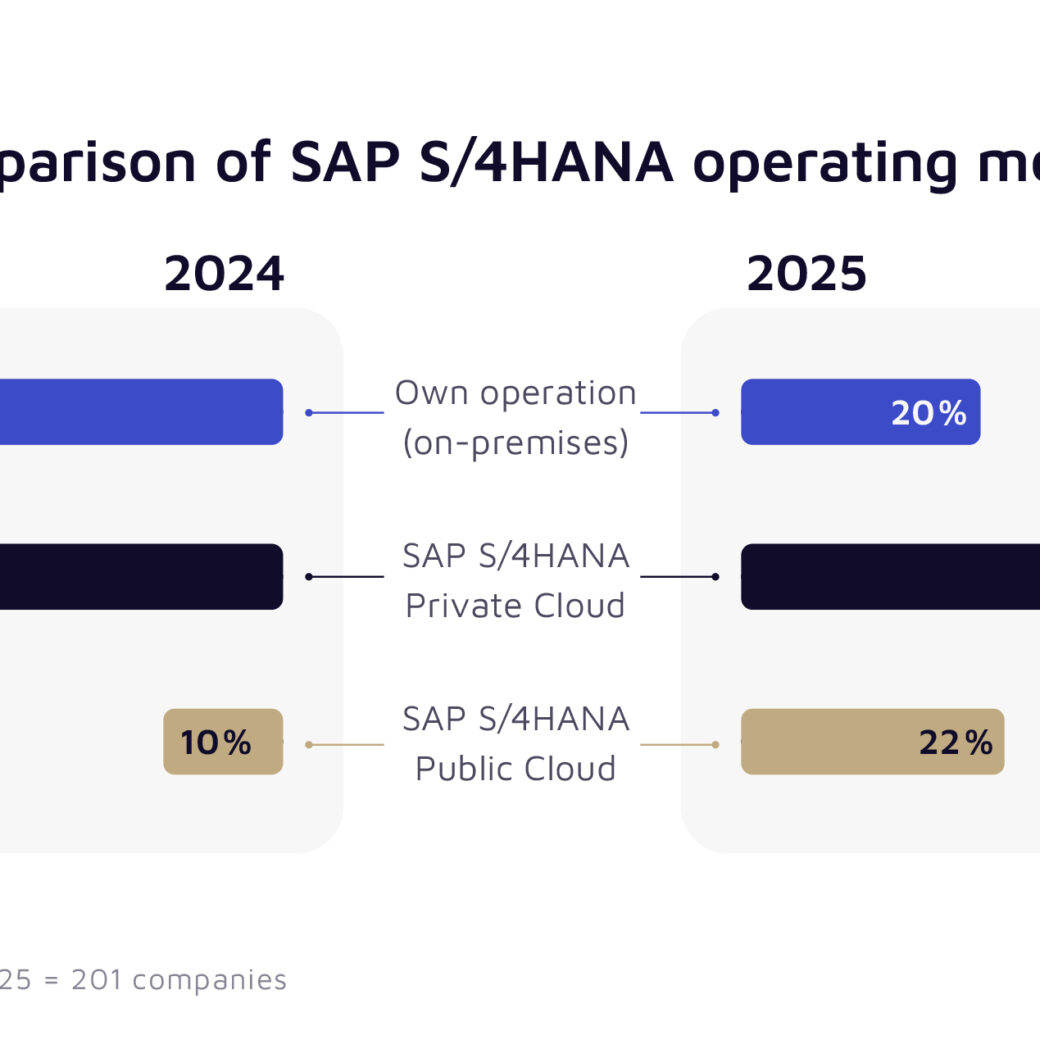

The transition in operating models (i.e., the choice between on-premises, private cloud, and public cloud) was even more distinct. The share of companies with cost-intensive but highly controllable in-house operations (on-premises) is declining rapidly. While nearly 60% of companies surveyed in the previous year still relied on on-premises infrastructure (see valantic’s 2024 Study), this figure has dropped to just 20% in 2025, driven primarily by the automotive sector (60%).

On-premises operations are steadily being replaced by SAP S/4HANA Private Cloud, whose adoption has nearly doubled from 31% to 58%, highlighting growing organizational confidence in managing cloud-based architectures. However, this transition hinges on a crucial factor: the ability to effectively migrate existing customizations and integrations, which remains essential for safeguarding prior investments. Highly regulated industries value the private cloud for its balance between controllability and scalability. These include sectors such as finance (67%), specialized manufacturing (e.g., mechanical engineering, high-tech, and equipment manufacturing at 59%), and the public sector (67%).

According to valantic’s cloud synopsis, the discourse around cloud transformation projects has evolved markedly in recent years. No longer fueled by technological exuberance alone, the focus has shifted toward a more measured and pragmatic approach. Yet, the overarching direction remains clear: organizations are pursuing progress through controlled evolution rather than disruptive overhaul. A strategy that combines modular migration with selective cloud adoption delivers this balanced path forward.

AI is no longer a futuristic vision in the SAP world, but has long been a part of the SAP ecosystem—it is a present-day reality with a tangible business impact. Today, 29% of companies already integrate AI into their core business processes, marking a 22-percentage-point increase over 2024. An additional 51% are expected to adopt AI services for the first time in 2025, initially implementing them selectively in their specialist departments on a project-by-project basis.

This highlights a sharp increase in AI maturity compared to the previous year, when most initiatives were still in the strategic planning stage. valantic’s research project, Digital 2030: The Rise of Applied AI, also confirms this progress, revealing that 76% of the over 680 SAP user companies surveyed are already generating measurable and concrete value from their AI applications. The transformation has now finally reached the operational core.

In 2025, SAP BTP continues to serve as the technological backbone of SAP transformations, but its role within the system landscape is evolving distinctly. While its primary function last year centered on integration (with 64% consensus), the emphasis is now shifting toward delivering tangible value and driving automation. Consensus for integration, previously the leading use case, has fallen to 30%.

BTP is thus transitioning from a purely infrastructural component to a strategic enabler of data-driven innovation. This shift is especially evident in the growing adoption of the platform’s analytical capabilities. SAP Analytics Cloud—now actively used by 60% of companies, rising to 73% following an S/4HANA transformation—serves as the central front end for reporting and dashboarding.

49% of Respondents Agree: “The SAP Business Data Cloud (BDC) Opens up New Opportunities for Us to Exploit the Full Potential of GenAI.”

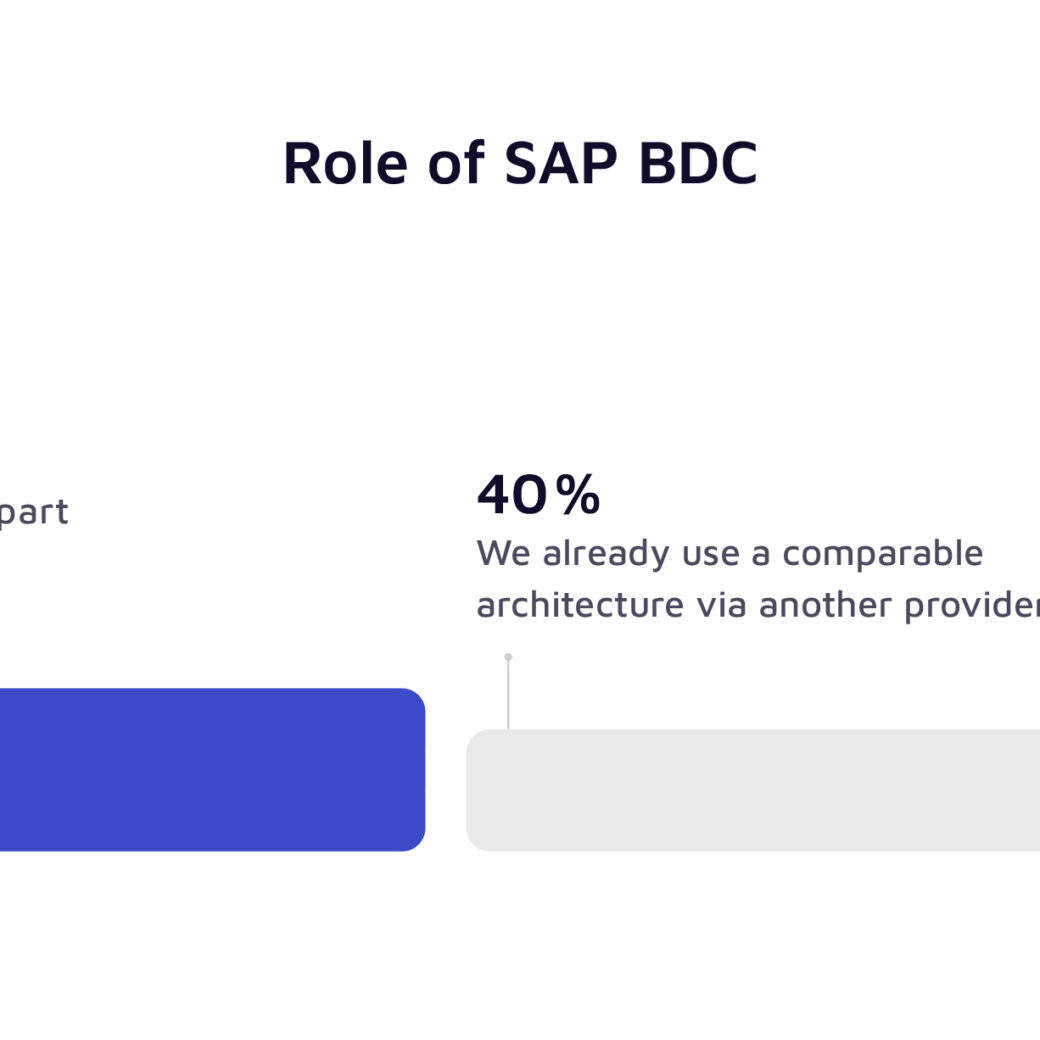

The SAP Business Data Cloud (BDC), a unified and high-quality data platform, is gaining strategic significance as companies advance toward data-driven business models. Over half of the surveyed IT managers (54%) already consider the BDC a cornerstone of their future data management strategies. This trend is especially pronounced in the automotive (80%) and DMI (59%) sectors, and remarkable, given that BDC is still a relatively new platform with evolving capabilities. Nearly half of respondents (49%) believe SAP BDC could play a pivotal role in unlocking the potential of generative AI, while 47% see it as a means to streamline system integration and eliminate data silos. valantic’s SAP Study 2025 clearly shows how organizations are increasingly perceiving next-generation data platforms as key enablers of innovation, particularly, though not exclusively, in conjunction with generative AI.

valantic SAP Study 2025: Transformation. Data. Future.

The research project, conducted in cooperation with techconsult (Heise Group), provides comprehensive insights into the strategic decisions made by companies using SAP solutions.

Source: valantic

Companies are increasingly showing a willingness to act and are moving from the planning phase to operational implementation.

Source: valantic

Last year's frontrunner Brownfield is replaced by the hybrid migration methodology.

Source: valantic

Trend shift from “in-house” deployment (on-premises) to SAP S/4HANA Private Cloud.

Source: valantic

Many companies appreciate SAP BDC as strategic element in data management.