Highlight

Successful together – our valantic Team.

Meet the people who bring passion and accountability to driving success at valantic.

Get to know usvalantic viewpoint

A fragmented market has professionalized rapidly, as practices increasingly outsource billing, adopt integrated platforms, and seek faster liquidity.

This is an excerpt of our viewpoint on Private Medical Billing Services Germany. Get in touch if you would like to learn more about the market dynamics, business model, competitive landscape and growth drivers in this market.

€2tn

European factoring turnover

60%

of outpatient private billing is already outsourced

25%

of practice revenue comes from only 10 % private patient cases

Executive Summary

Private medical billing services in Germany sit at the intersection of rising administrative complexity and physician capacity constraints. Practices increasingly outsource private invoicing, receivables, and liquidity management to specialist partners, while digitization enables automation, analytics, and scalable workflows. Consolidation from solo practices into group practices and medical care centers raises the bar for structured, data‑driven billing. Structural tailwinds include upcoming GOÄ updates, growing acceptance of digital tools, and regulatory moves that shorten payment cycles and expand invoice financeability.

Competitive dynamics remain fragmented, with regional service providers, physician‑run PVS networks, digital‑first platforms, and premium full‑service RCM specialists all vying for share. The winning propositions combine deep GOÄ expertise with automation, end‑to‑end receivables management, and optional pre‑financing, creating sticky relationships and room for monetizing platform modules. Selective M&A and product expansion in financial services further support growth.

Outsourcing and platform adoption rose as practice workloads and cost pressure increased.

Hybrid models, that blend expert support and automation, captured higher realized fees.

Regulation and MVZ consolidation reshaped demand, favoring scalable, analytics‑ready providers.

Outpatient providers increasingly outsource private billing, with ~ 60 % already externalized and room to grow as cost pressure persists. Younger physicians and part‑time patterns amplify demand for administrative relief, while even analogue practices adopt digital tools. Consolidation into group practices and MVZs raises requirements for structured, KPI‑driven billing, nudging the market toward platforms that automate GOÄ coding, plausibility checks, and dispatch. These forces set the stage for providers that combine service depth with software scale.

Key Takeaways:

Upcoming GOÄ updates increase coding complexity and change frequency, favoring partners with expert review and update‑ready platforms. Private patients represent roughly 10 % of cases, yet ~ 25 % of practice revenue, underscoring the stakes of accurate private billing. Liquidity needs sharpen as receivables timing stretch, making pre‑financing and receivables management valuable. With practices seeking error reduction, faster collections, and real‑time insights, hybrid solutions that bundle consulting, automation, receivables, and optional financing address multiple pain points at once.

Key Takeaways:

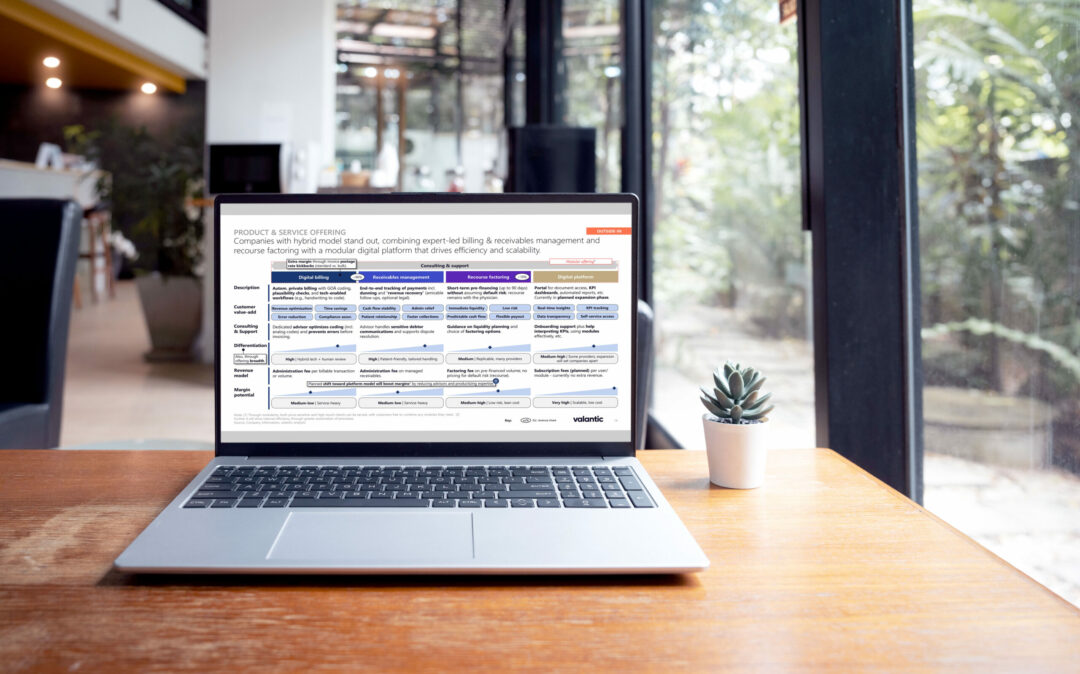

The market remains fragmented. We see four archetypes: regional service providers offering GOÄ billing and personal support; physician‑run PVS networks with traditional RCM workflows; digital‑first billing platforms that emphasize interfaces and automation; and premium full‑service RCM specialists that combine deep GOÄ consulting, end‑to‑end receivables, and optional pre‑financing. Segment specialists focus on areas like dental or therapies with tailored processes. Differences concentrate around value‑chain coverage, financing capability, consulting depth, and platform maturity. No true national scale player emerges, given regional anchoring and limited consolidation to date. Buyers weigh low‑touch automation against higher realized fees from consultative, hybrid models.

Key Takeaways:

End‑to‑end coverage starts with documentation support and GOÄ coding, proceeds to invoice QA and dispatch, and extends through receivables management and optional pre‑financing. Hybrid providers pair expert reviewers with automation and analytics. Monetization mixes per‑invoice admin fees, fees for receivables services, and margins on (non-)recourse factoring. Platform modules, such as dashboards, benchmarking, and automated reports, unlock recurring software‑like revenue while improving internal scalability. The ability to manage collections with patient‑friendly handling and structured escalation often translates into higher net collections and stronger retention.

Key Takeaways:

Near term, growth comes from cross‑selling platform modules, such as KPI dashboards and automated reporting, to existing practices and from expanding receivables and recovery services. Medium term, broadening financial services, for example, patient payment plans or low‑risk insurance products, increases share of wallet and differentiates the proposition. Selective regional consolidation adds scale and enables migration to a unified platform, improving unit economics. Macro tailwinds, including lower funding costs and tighter payment terms, support the uptake of financing features. The combination of high‑touch expertise and increasing internal process automation positions leading players as attractive assets for strategic or secondary sponsors in the next cycle.

Key Takeaways:

Want the full breakdown? The full viewpoint on Private Medical Billing Services is available on request.

The typical scope includes market size, market trends & drivers, competitive landscape, competitor groups, competitor benchmarks, explanation of the business model, value chain and future growth levers.

Christoph Nichau

Partner & Managing Director

Private Equity Practice

Jan Dingerkus

Partner & Managing Director

Private Equity Practice

Khalid Ouaamar

Managing Director

Private Equity Practice