Highlight

Successful together – our valantic Team.

Meet the people who bring passion and accountability to driving success at valantic.

Get to know usvalantic viewpoint

The dental materials and prosthetics market is transforming through digital workflows, advanced materials, and shifting customer structures.

This is an excerpt of our viewpoint on the Dental Materials and Prosthetics Market. Get in touch if you would like to learn more about the market dynamics, business models, competitive landscape, and growth drivers in this market.

Executive Summary

The dental materials and prosthetics market has evolved rapidly, powered by digital CAD/CAM adoption and advanced material innovation. Zirconia has emerged as the dominant material for permanent restorations, while polymers and 3D printing resins expand into temporary and additive solutions. Consolidation of dental laboratories, with a decline of ≈4 % in Germany in 2022, shifts buying power towards fewer, larger players demanding integrated solutions.

Competition clusters into four archetypes: global enterprise integrators, SME specialists, niche single-category experts, and hybrid labs with digital milling services. Future positioning depends less on breadth and more on the ability to combine innovation, pricing, and service. Profitability remains strong, with typical leaders generating EBITDA margins above 20 %, supported by in-house production and hybrid distribution. Growth is further fueled by international expansion, integration of digital workflows, and platform strategies extending into implants and chairside solutions.

Digital workflows accelerate material adoption and reshape prosthetics supply chains.

Lab consolidation concentrates buyer power, increasing pressure on suppliers to deliver integrated solutions.

Integrated players with in-house production and hybrid distribution capture above average margins (>20 %).

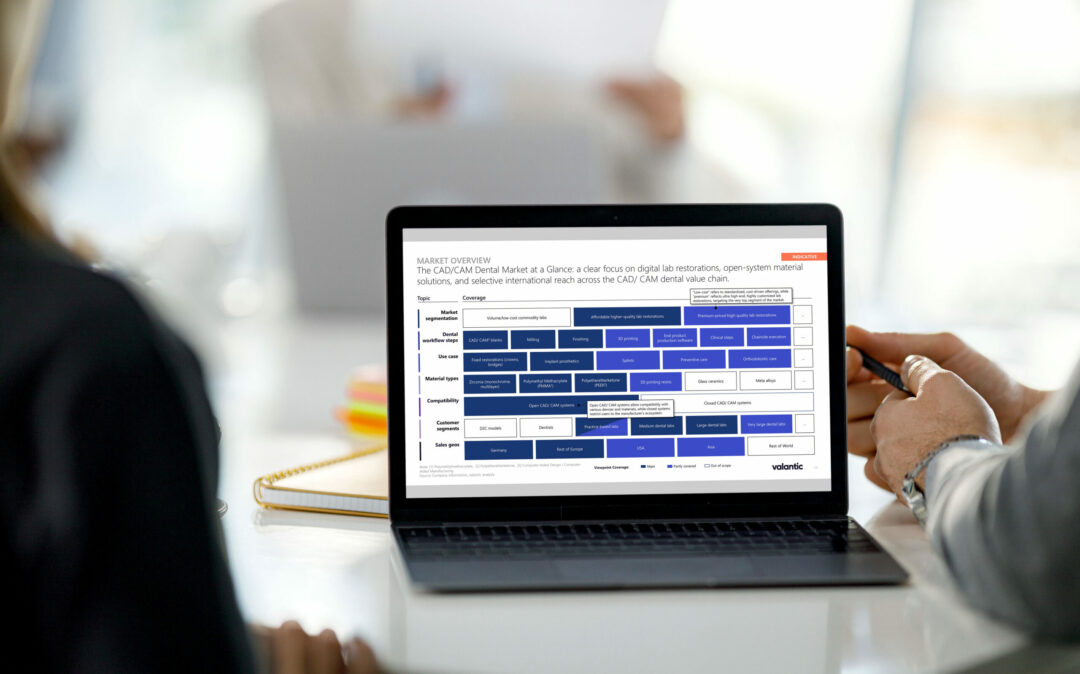

The dental materials and prosthetics market has undergone a shift toward CAD/CAM workflows. Making Zirconia the most used material for crowns and bridges. Polymers like PMMA and PEEK supplement temporary prosthetics, while 3D printing opens new applications. Laboratory consolidation, evidenced by a 4 % reduction in German labs in 2022, favors larger labs with digital capabilities. This trend accelerates adoption of system-agnostic solutions and integrated service models. For investors, this marks a clear inflection point: those players who adapt to digital workflows and scale alongside consolidating labs are best positioned to capture durable growth.

Key Takeaways:

Demand in the market is powered by a combination of patient expectations, cost efficiency, and laboratory economics. Patients increasingly expect restorations that are not only durable but also highly aesthetic, fueling the rise of translucent zirconia as the material of choice. Dental laboratories, under pressure from consolidation and competition, are adopting digital workflows to optimize efficiency and reduce turnaround times. Hybrid distribution models that balance direct sales with selective third-party distribution remain attractive, particularly for mid-sized labs seeking both quality and affordability. Larger laboratories are consolidating purchasing volumes, strengthening their bargaining power and demanding higher service levels from suppliers. At the same time, disruptive chairside CAD/CAM systems present a double-edged sword: they risk displacing traditional lab workflows for single-tooth restorations but also open up opportunities for suppliers able to extend into dentist-facing solutions.

Key Takeaways:

The competitive environment is highly fragmented but increasingly structured around four main archetypes. First, enterprise providers offer broad portfolios that span materials, implant components, and digital technologies, serving high-volume industrial labs but often at higher cost and with less direct service. Second, SME specialists combine depth in materials and components with direct access to medium-sized labs, offering a compelling mix of affordability and personal service. Third, niche players focus exclusively on a single product category, excelling in quality but leaving labs dependent on additional partners for a full workflow. Finally, hybrid providers integrate milling centers and digital services, creating closer ties with labs and capturing value-added work that smaller customers cannot handle in-house. As consolidation accelerates, competitive positioning depends less on breadth alone and more on the ability to combine innovation, service, and pricing.

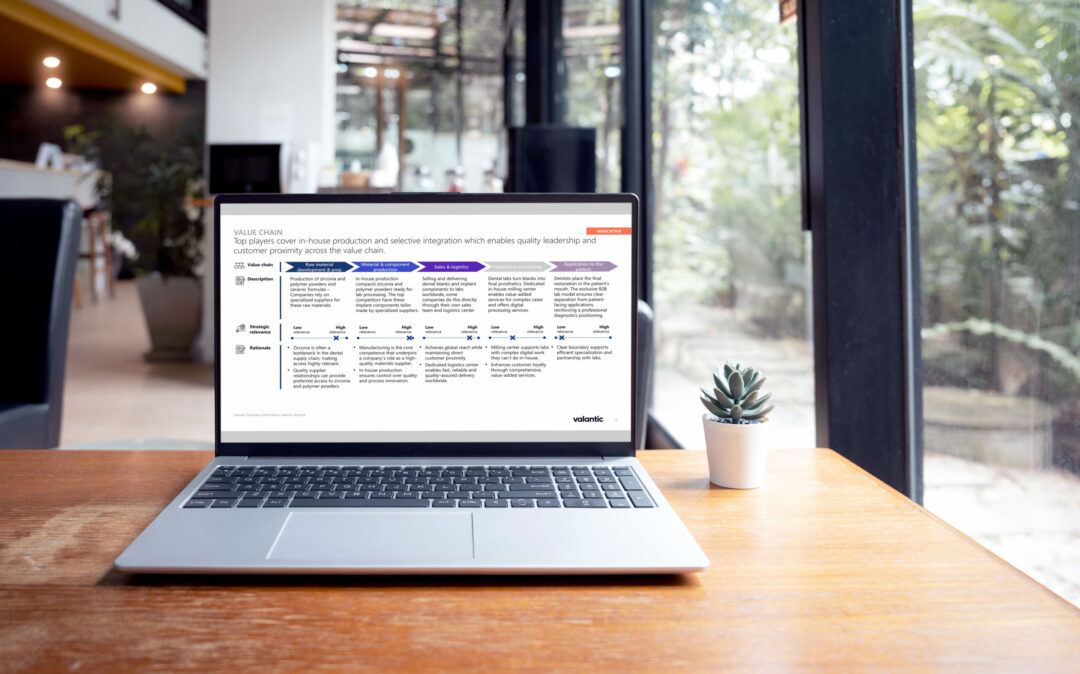

The value chain stretches from raw material sourcing to the final patient application, with integration levels determining profitability and resilience. Most suppliers rely on specialized producers for zirconia and polymer powders, as these raw materials are bottlenecks in the global supply chain. In-house production of blanks and semi-finished materials represents the core competence of leading players, ensuring control over quality, process innovation, and margins. Sales models vary, with direct distribution to laboratories increasingly favored over intermediaries, enabling closer customer relationships and higher loyalty. Milling and technology centers extend the value chain further, allowing suppliers to handle complex digital cases and provide technical support. This integrated model enhances stickiness and differentiates players from low-cost competitors in Asia, who may struggle with speed and customer intimacy.

Key Takeaways:

Future growth in the dental materials and prosthetics market will be unlocked through international scale, technology adoption, and platform strategies. Expansion into high-growth regions such as the US and Asia provides significant upside, as CAD/CAM penetration is still uneven globally. Additive manufacturing, particularly in polymers and resins, offers a fast-growing opportunity for suppliers who invest early in 3D printing workflows. At the same time, buy-and-build strategies allow investors to consolidate fragmented niches, integrating smaller software providers, implant specialists, and milling centers into broader platforms. R&D will continue to focus on material innovation, with higher translucency zirconia and biocompatible polymers opening new applications and raising barriers to entry.

Key Takeaways:

Want the full breakdown? The full viewpoint on the Dental Materials and Prosthetics Market is available on request. The typical scope includes market size, market trends & drivers, competitive landscape, competitor groups, competitor benchmarks, explanation of the business model, value chain and future growth levers.

Christoph Nichau

Partner & Managing Director

Private Equity Practice

Jan Dingerkus

Partner & Managing Director

Private Equity Practice

Khalid Ouaamar

Managing Director

Private Equity Practice