Electronic Trading

Electronic trading and automation systems for Capital Markets

We augment and replace existing platforms with modular and fully customizable automated workflow solutions.

Electronic Trading

We augment and replace existing platforms with modular and fully customizable automated workflow solutions.

2022 • 2023 • 2024 Winner

Best Fixed Income Trading Solution

2022 Winner

Best Fixed Income Trading Workflow Solution

valantic FSA in Fixed Income

Our Fixed Income Trading platform is functionally rich and operates at the highest level across pricing, quoting and execution for the most demanding D2D & D2C markets.

It includes highly adaptable workflows that bring superior levels of efficiency, insight, and business agility through:

Report Q2 2024: Investing to meet the demands of an evolving market

This edition features significant updates: our network now includes both buy-side and sell-side fixed income participants. We explore firm performance in 2023, the anticipated impact of T+1 settlement rules in the US, and the growth…

valantic FSA in Equities

Our Equities platform supports highly adaptable liquidity provision for all securitized instruments, and brings superior levels of efficiency, insight and business agility to our clients.

Solutions

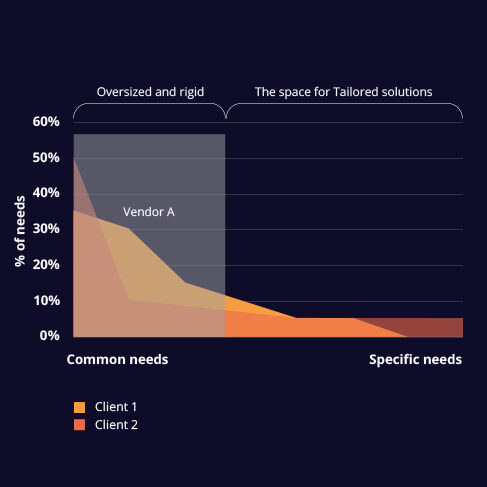

Legacy products and vendors cater for the most common requirements with a rigid offering, leaving a long tail of needs unattended. Solutions is a modern technology stack and a partnership model that can be used to fill the efficiency and compliance void left.

We can quickly deliver an intuitive web UI on top of existing and new workflows to:

Solutions gives you the ability to rapidly reshape your systems and adapt them to your real needs.

Factsheet: valantic FSA Solutions

Need to add new functionality and extract information from your old systems? Still manually gluing together old fragmented systems? Concerned to miss an opportunity because you won‘t be fast enough to change your old systems?…

valantic FSA erases technical debt with flexible technology and automated workflow systems.