With its SAP S/4HANA Study 2022, valantic has this year again identified the latest market trends and developments concerning the ERP software suite. The survey examines a broad range of topics including the acceptance of the business software among SAP user companies and the added value they expect from a migration. It was conducted for the fifth consecutive year in 2022, this time supported by IT-Onlinemagazin as a media partner. The survey focused on the cloud, RISE with SAP and process mining.

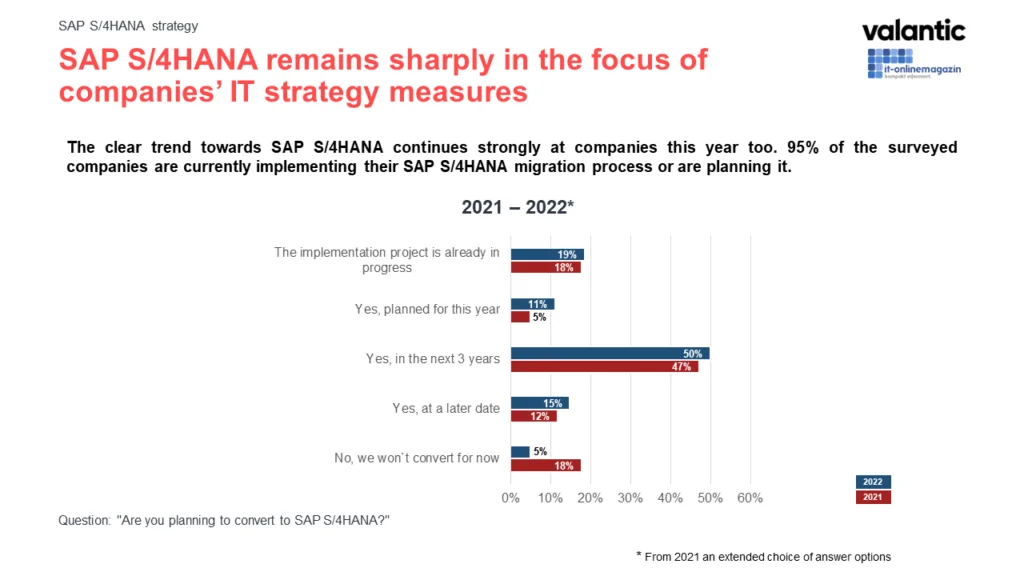

The results of the 2022 study clearly show that the switch to SAP S/4HANA is a high priority for the vast majority of the polled experts (94%, 2021: 82%). 19% of them have already started with the implementation. 11% of the participants want to start with the migration this year – more than double the number reported in 2021. A constant trend can be seen in the share of companies planning a migration in the medium term, with 50% (2021: 47%) intending to initiate a corresponding project within the next three years. 15% have the changeover on their agenda at a later date (2021:12%). This contrasts with the clear downward trend in the share of those not planning a switchover in the foreseeable future: within just one year, this has plummeted a good two-thirds, from 18% of respondents in 2021 to just 5% now.

The market is thus very conscious of the fact that, in view of the impending end of maintenance for older SAP ERP systems in 2027, little time remains for the changeover. The shortage of available IT professionals and external consultants for implementation further exacerbates the situation.

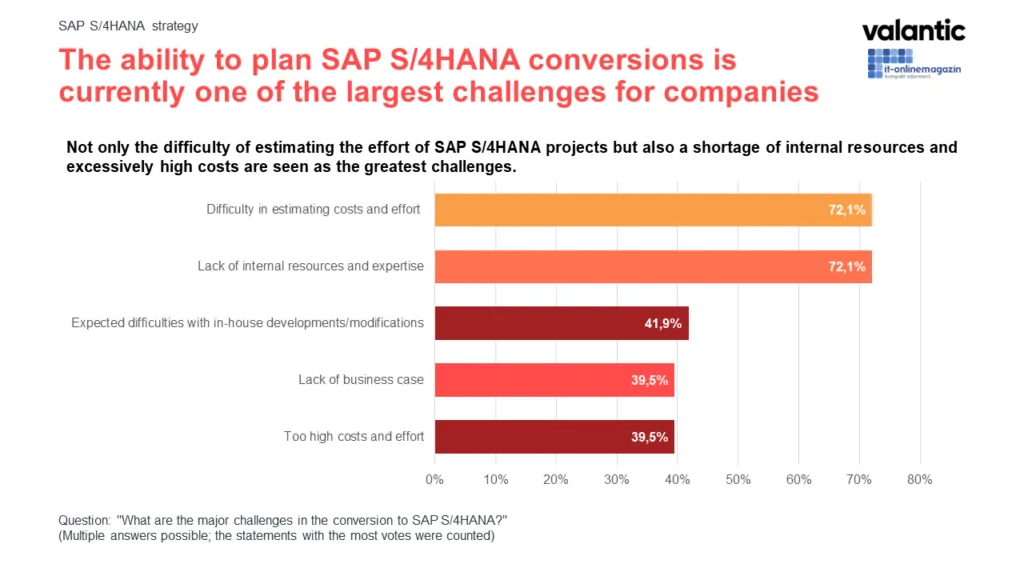

This is reflected in our current study. Over 72% of the participating companies cited this point as a challenge. The same proportion, 72%, also cited estimating effort and costs as a difficulty. Potential complications with in-house developments and system modifications follow a long way behind in third place (at just under 42%). 39.5% of those surveyed stated the lack of a business case and, again 39.5%, expected high costs as stumbling blocks.

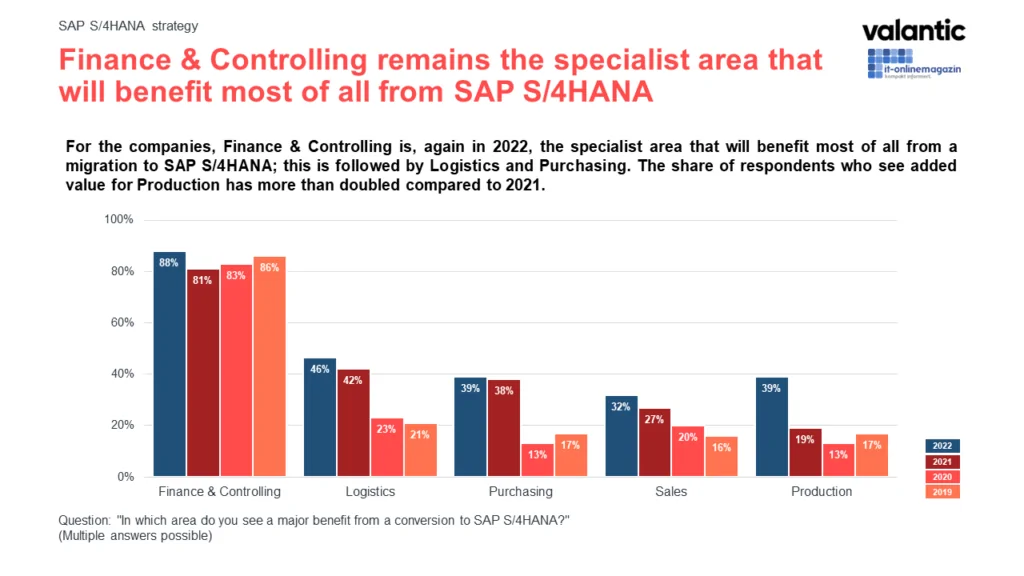

From the outset, companies have seen the greatest benefits of a SAP S/4HANA migration in Finance & Controlling. In our previous surveys, over 80% agreed on this, already back in 2019, while the areas of Logistics, Purchasing, Sales, and Production initially ranked at around 20% and below. This year, 88% of respondents saw clear added value for finance organization, which benefits from SAP S/4HANA’s real-time analytics, among other things. 46% of participants expect major benefits for logistics, followed by 39% for purchasing.

What is new is that 39% of respondents now also see benefits for production – twice as many as last year (19%). The sharp increase indicates that SAP user companies are now increasingly focusing on end-to-end digitization and thus on the production area downstream from the digital core.

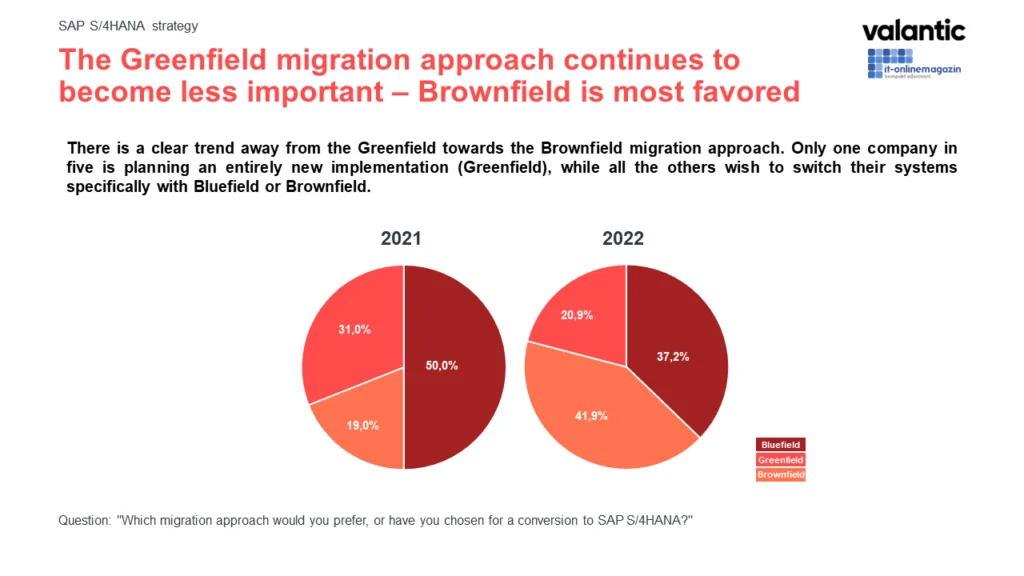

This year’s study lays bare another interesting trend in terms of the preferred migration strategy. Almost 42% of the participating companies favored the brownfield approach here – more than double the number in 2021 (19%). Only just under 21% continue to favor a new implementation using the greenfield approach (2021: 31%). The bluefield approach, which combines greenfield and brownfield elements, is preferred by around 37% of participants in this year’s survey, compared to 2021 when it was still the clear favorite at 50%.

This shows an increasingly even distribution of companies’ preferences for one of the three available migration method, each of which offers specific advantages depending on the initial situation and requirements: A brownfield system migration, for example, enables a smoother transition to SAP S/4HANA compared to greenfield new implementation, since the migration of the ERP system can wait until a technical upgrade occurs. The approach is particularly suitable for companies that do not have extensive optimization needs and are simply seeking a quick and resource-friendly migration in the first step. We nevertheless believe it is still advisable to implement subsequent optimizations so as to leverage the maximum benefit from SAP S/4HANA, rather than making do with simply a pure system conversion.

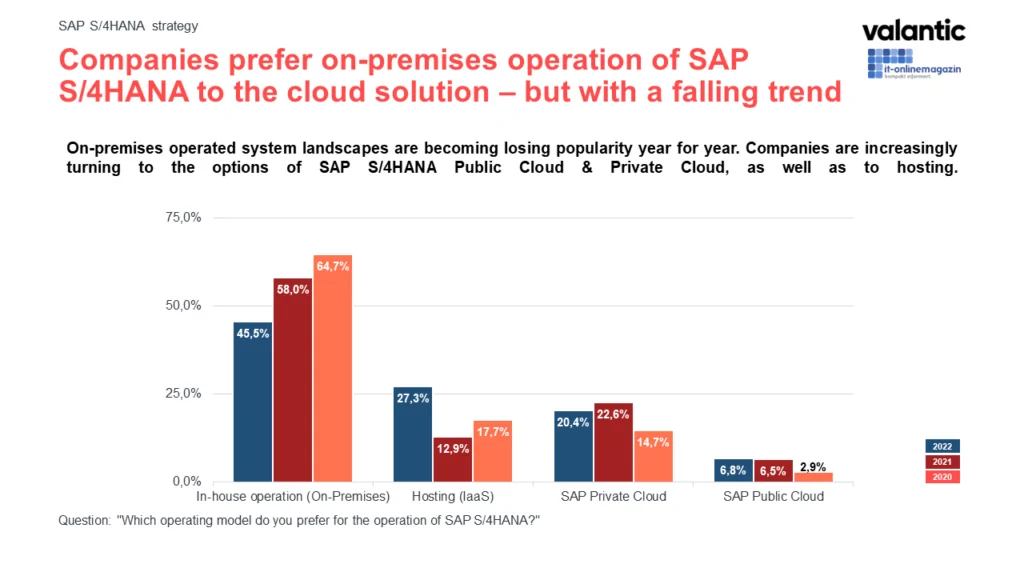

In terms of system operation, most respondents still stated a preference for the on-premises model, albeit with a steadily declining trend. Whereas in 2020 almost 65% of companies said they wanted to operate the software themselves, this time the share is around 45%. Those not wishing to operate their SAP system themselves have basically two options: hosting at an external data center and operation in the cloud by SAP or other hyperscalers. Here, hosting is currently the participants’ favorite at around 27%, just ahead of SAP’s Private Cloud offering at around 20%. SAP’s Public Cloud operating model continues to play a minor role at just 6.8%.

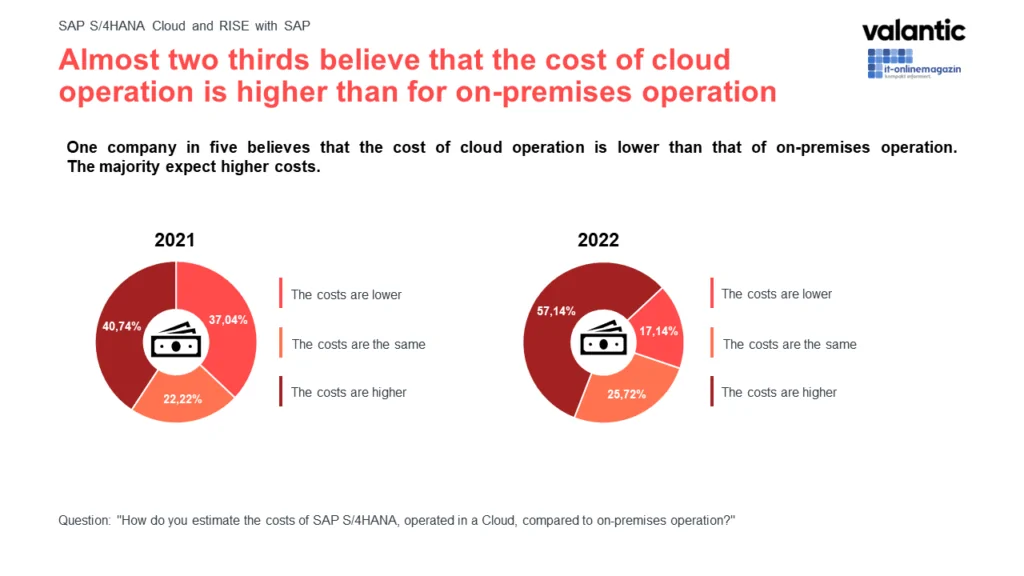

When considering the values, it should be taken into account that the Private Cloud offering has only been available since the beginning of 2021 and, as our current survey shows, is still unknown as an operating model to around 20% of participants. Moreover, our day-to-day consulting work shows that the operation of SAP S/4HANA by SAP is approximately just as costly as hosting at an external data center. Our study results confirm this. Apparently, SAP’s cloud model is still unable to convince companies sufficiently in terms of price: Around 57% of respondents expect higher costs for cloud operation than for in-house operation. Around 26% expect the same costs, while only around 17% anticipate lower costs. Nevertheless, 80% of the surveyed companies fundamentally find cloud operation interesting.

When choosing the operating model, we recommend comparing the variants on the basis of total cost of ownership. valantic offers a service based on a SAP calculation tool for analyzing the TCO of the on-premises, private cloud and public cloud deployment models.

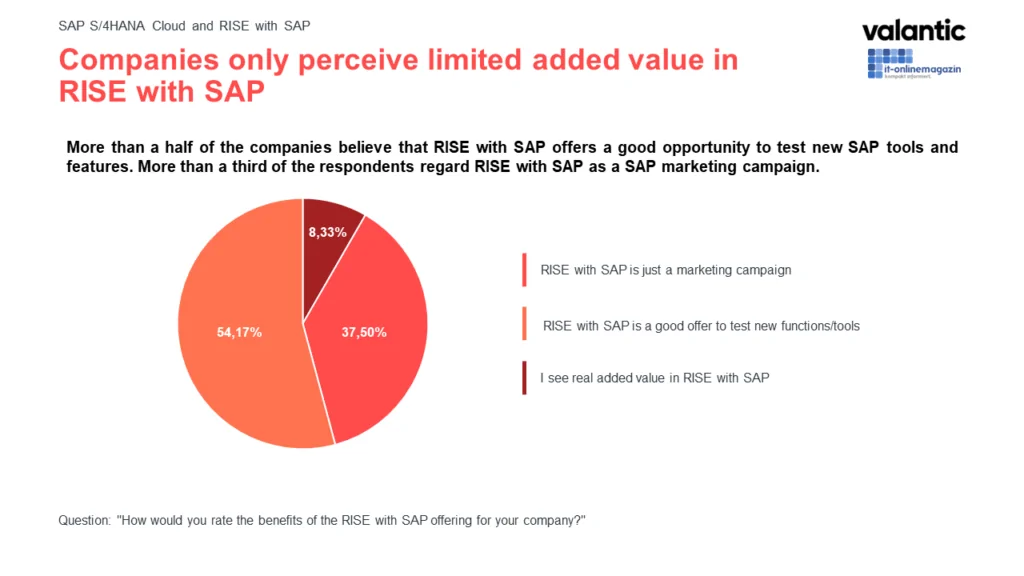

Since the beginning of last year, SAP has been offering its customers RISE with SAP, a Transformation-as-a-Service (TaaS) model for migrating to SAP S/4HANA. Our study showed, however, that the offer is not clearly understood by the SAP community. Only a circa 8% minority can see any real added value in it. Nevertheless, around 54% of respondents consider RISE with SAP to be a good offering for learning about new features and tools. 37.5%, on the other hand, see it merely as a marketing campaign by SAP. Be that as it may, RISE with SAP is essential for the move to the cloud and offers interesting options for this. In view of the complexity of the offering, however, further clarification is clearly still needed in this area.

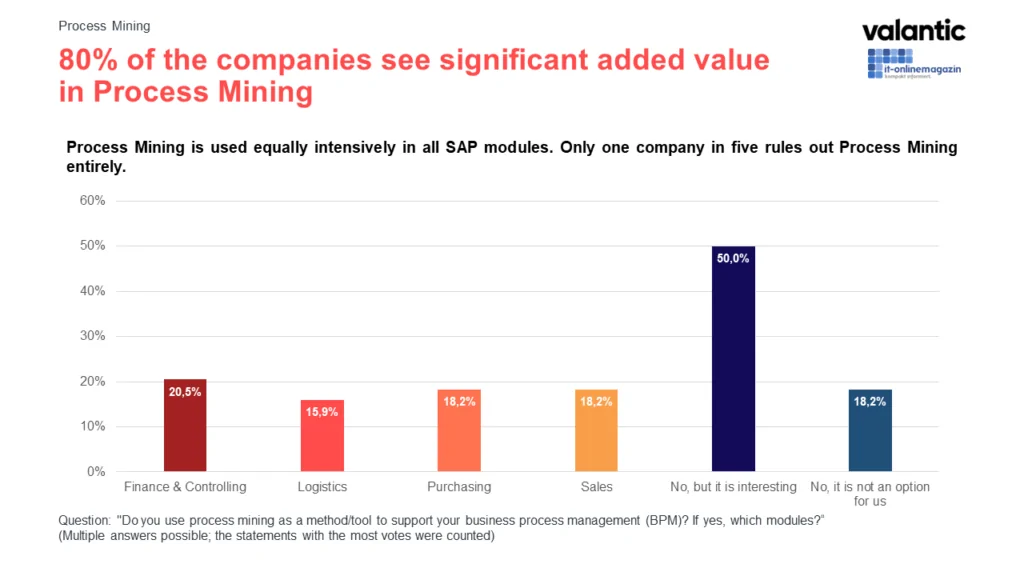

Business process intelligence plays a key role in the course of digital transformation. This is why this year’s SAP S/4HANA Study focused more closely on process mining, i.e. the tool-supported analysis of business processes in system environments. Over 80% of the respondents recognize clear added value in this – even if 50% do not currently use it, they still perceive it as interesting. Only about 18% ruled out process mining entirely.

The market is clearly experiencing a trend towards SAP S/4HANA transformation – not least because time is pressing for the changeover. Nevertheless, the goal of most companies planning their digitization is not only to upgrade to the latest infrastructure, but also to implement more intelligent, transparent and standardized processes overall and leverage their potential for automation. While interest in cloud-based system operation is growing, many reservations and a lack of clarity still exist in the community. The pricing model is also not clearly understood by many. And further clarification is also needed for the RISE with SAP migration offering to illustrate the added value of transformation-as-a-service.

Don't miss a thing.

Subscribe to our latest blog articles.