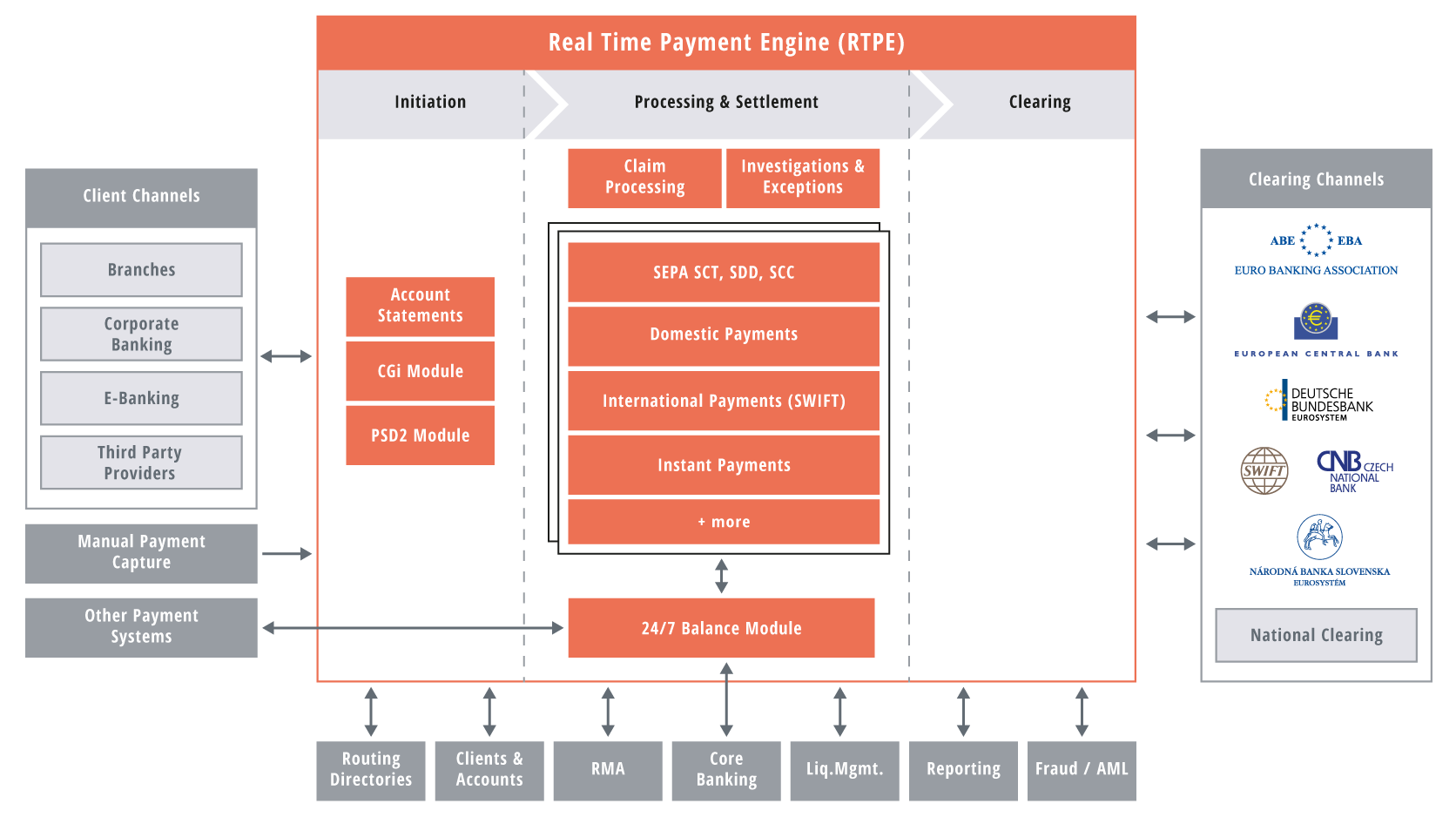

For detecting criminal activities, the evaluation of data will be particularly important, too – the more transparent the processes are, the earlier fraud and money laundering can be identified. Fraud detection is to be applied not only towards external access but also towards manipulations from within. Thanks to artificial intelligence, all processes and transactions can be monitored in real time, regardless of the data volume. Thereby, no known fraud patterns are searched but the entire behaviour of users and bank clients is checked for anomalies, so that even risks arising from new fraud methods which are not known yet are secured as far as possible.

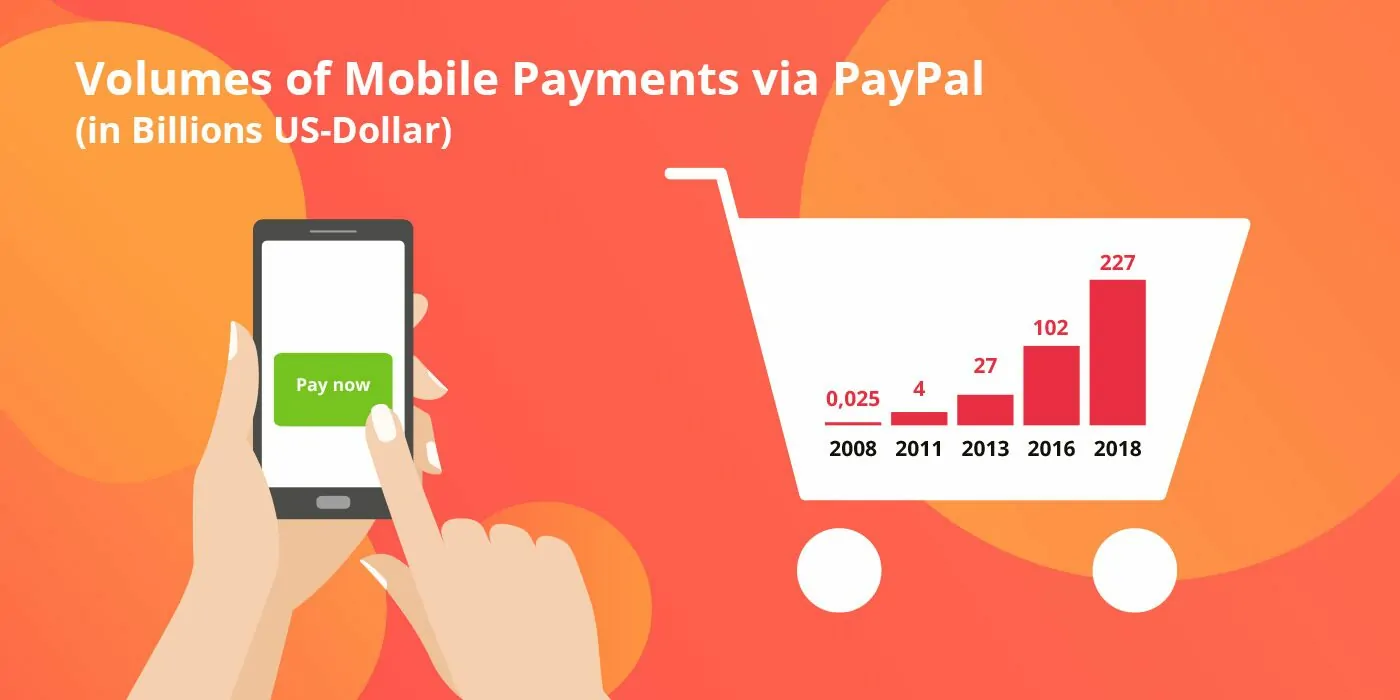

Real-time payments also provide a platform for further innovation: processes such as e-invoicing and e-commerce payment solutions are also supported by real-time payment systems and allow the customers more control over their money. Consumers as well as companies directly pay from their accounts. This payment method is cost-effective, fast, secure and enables an immediate verification and confirmation of the credit balance. It helps traders to reduce their exchange costs and helps banks to maintain the direct relationship to their customers. The most important, however, is that it meets the consumers’ expectations in today’s world.