The E-Invoice – a Required Step toward Digitalization

October 6, 2020

October 6, 2020

With the introduction of the regulation about electronic invoicing (e-invoice) in public administration, digitalization is advancing further in finance and accounting. Thanks to the rising trend toward digitalizing and automating business processes at companies, paper invoices via mail or fax will soon be a thing of the past. Due to the E-invoice regulation, companies are relying increasingly on electronic invoices that can be created, sent, and processed automatically. This way, they are not only complying with legal standards in the B2G sector (Business-to-Governance), they will also profit in the long term from cost savings due to shorter process throughput times and generate savings due to minimal manual administrative effort. In order to guarantee electronic exchange of invoices in the B2G and B2B sectors, the invoice receipt and sending processes have to be re-thought and the system environment adjusted accordingly.

What is the E-invoice regulation?

Starting on November 27, 2020, the E-invoice regulation (E-Rech-VO) will apply for electronic invoicing in federal public procurement. Thus, all suppliers of the German federal government are obliged to transfer invoices only in electronic form and in a structured output format.

Since April 17, 2020, in addition to the federal ministries, constitutional bodies, and federal authorities, states and communities also have to be in a position to receive and process electronic invoices in structured form.

In the B2B and B2C sectors, companies are still flexible with regard to electronic invoices. However, it is recommended that companies not delay discussing E-invoices as part of their digitalization strategy much longer. Companies are already reaping the medium- and long-term benefits in that because of E-Rech-VO, they have already converted their entire invoicing process insofar as possible.

What’s an E-invoice according to the EU directive?

An E-invoice according to EU directive 2014/55/EU means that an electronic invoice counts as an invoice if it is issued, transferred, and received in a structured electronic format. This should enable automatic and electronic processing.

What data format does an electronic invoice need to have?

The standard format for an electronic invoice was passed by the IT planning council in Germany; this is the so-called XRechnung. The XRechnung is a purely structured XML file that corresponds to the CEN-compliant national invoice data standard according to the standard EN-16931. The standard EN-16931 also determines the structured data format. Meanwhile, in addition to the XRechnung,ZUGFeRD 2 is allowed as a possible alternative; in addition to a purely structured XML file, it also offers a PDF file for visual display of the invoice. Thus, ZUGFeRD 2.0 is a hybrid data model. For suppliers, this means that they need software in which they can format and create the structured data.

How can electronic invoices be created in a structured data format?

The XRechnung and ZUGFeRD 2.0 can be created directly from the ERP system. For this, an add-on has to be set up and installed; it has to be in a position to format and create structured data formats. In addition to service providers who make suitable software available, SAP also already offers a standard solution in eDocument Compliance. The SAP module Application Interface Framework (AIF) makes it possible to transform the electronic documents into country-specific formats such as ZUGFeRD 2.0 and XRechnung. In addition to creating the standardized eDocuments, SAP offers accounting an overview of all documents with the eDocument Cockpit (EDOC_COCKPIT). In the future, it will be possible to expand the capabilities of SAP Finance with these modules.

Which transmission channels can be used?

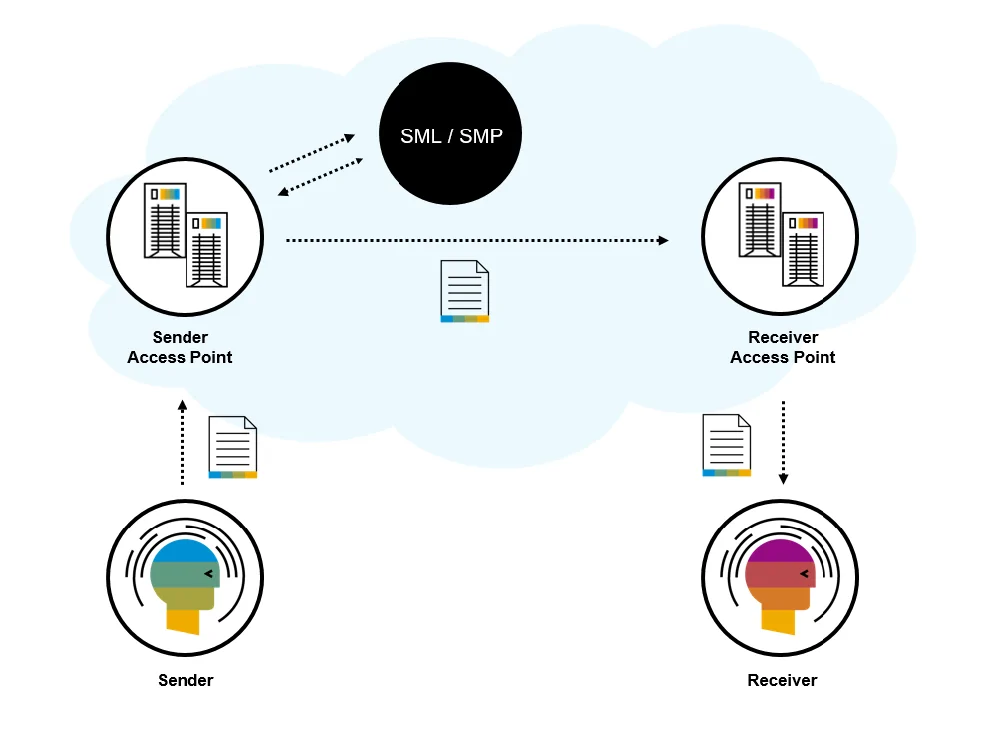

In addition to formating this data from the ERP system, the invoices have to be sent via a legally-compliant transmission channel. These include the Zentrale Rechnungseingangs-Plattform [Central invoice receipt platform] (ZRE) and Onlinezugangsgesetz-Rechnungseingangs-Plattform [Online access invoice receipt platform] (OZG-RE) as well as e-mail, DE-Mail, and the Peppol-Netzwerk. The Peppol network (Pan-European Public Procurement OnLine) is a network with which public administration and its suppliers can exchange electronic documents easily and cost-effectively. Furthermore, the Peppol network is becoming increasingly popular in the B2B sector as well. For a connection to the Peppol network, you have to have a certified provider – SAP offers this certified provider with the SAP Cloud Platform Integration as communications platform. However, for an exchange via the Peppol network, both the sender and recipient have to be connected to the network via an access point, as the figure shows in simplified form.

Challenges during the conversion

The biggest challenge for companies during the conversion is that, in addition to selecting the application for creating standardized invoices in XML format and the appropriate transmission channel, they also have to adjust their entire process chain for invoice receipt and sending. And then there’s the document archiving, which in the future will still require a 10-year retention period – archiving is also possible digitally.

Benefits of the E-invoice

The introduction of electronic invoicing not only complies with legal standards, it also produces some benefits. With the conversion, for example, companies will take an additional step toward digitalization, which will, in turn, make an important contribution to Corporate Social Responsibility (CSR) and thus save paper to protect the environment. In addition to the increased degree of automation and faster invoice processing, the documents can also be archived and kept digitally.

valantic helps its customers select the appropriate application and transmission channel and supports the entire implementation process. valantic creates transparency with regard to the work and costs required for customers’ invoicing, processing, and archiving processes, and it ensures that companies will comply promptly with the E-invoicing regulation.

Don't miss a thing.

Subscribe to our latest blog articles.